Home > Active Credit Repair > Consumers May Benefit from Consistent Credit Repai...

Consumers May Benefit from Consistent Credit Repair Services

Posted on April 22, 2011

One of the essential components of credit repair is your ability to remain consistent in your efforts to keep your credit report accurate and your credit score as high as possible. Lenders today are looking for scores of 730 and above when making lending decisions at the best rates. It is in every consumer’s best interest to work on keeping their credit reports accurate and up to date.

One of the essential components of credit repair is your ability to remain consistent in your efforts to keep your credit report accurate and your credit score as high as possible. Lenders today are looking for scores of 730 and above when making lending decisions at the best rates. It is in every consumer’s best interest to work on keeping their credit reports accurate and up to date.

Why Consistency Matters

There is a heavy emphasis for consumers to monitor their credit history reports and every consumer has a right to check in with their reports annually at no charge. There is also opportunity to request free credit reports when you are denied credit. Your credit score does not come free with your reports but it is your history that is what really needs special attention.

Most consumers will look at their credit history at least once a year or when they need financing but that may not be enough to generate the highest credit score possible. In the interest of time management, it may be wise for consumers to seek third-party assistance in repairing their credit and being proactive about monitoring their credit activities.

Who Can Help

Credit repair services are available to aid consumers who are overwhelmed with credit repair information. Many times consumers are either in the dark about what they need to do to maintain good credit or they just don’t have the ability to negotiate with their creditors alone.

For situations like this, a credit repair agency can be an effective tool for repairing existing bad credit and improving your overall credit profile. Reputable firms will have the years of hands-on experience needed to successfully remove information contained in your reports. Credit repair specialists can assist you in identifying information that is actually eligible for disputing.

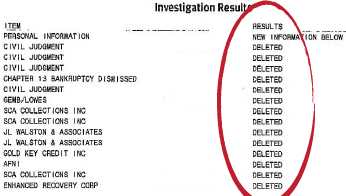

After researching the practices, success rate and reputation of several companies, we saw that Lexington Law stands out. We strongly recommend using this company to raise your credit score by deleting bad records. They have been in business for 19 years and helped remove over 1,000,000 negative items from their clients’ reports last year alone. Click here to see their results and learn more.

Credit repair specialists will be able to establish the dispute process with the major credit reporting bureaus. Once an item has been disputed, it is the obligation of the credit bureaus to investigate the matter directly with the creditor within a thirty-day time period. After the time frame has come to pass, the information that was incorrect must be repaired or removed to reflect its accurate status. If the reporting agencies do not receive timely correspondence from the creditors, they also have the obligation of removing credit items.

Follow through is one of the essential aspects of the process that consumers often fail to keep up with, resulting in the continued bad credit marks. The benefit of using a credit repair service is they will continue to go through the entire process of the disputed items for you. Once the correspondence is received from the investigations, the creditor or credit reporting agencies do not always follow through on their end. Credit repair services provide continued monitoring and they will repeatedly check credit reports to ensure information has been reported accurately and that consumers will see results through higher credit scores.

Credit repair services are important for those unable to repair their credit mistakes on their own for any reason. Credit reports and three-digit scores are an important reflection on the consumer and even one bad mark can harm your ability to get credit, good interest rates, and other financial assistance when you need it most.

Images provided by Lexington Law

The images above are courtesy of Lexington Law — one of the largest credit repair firms in the US. They have over 19 years of hands-on experience and a solid track record (see below). Lexington Law provides free consultations at 1-888-328-0115! If you’re interested in increasing your credit score, give them a call and they’ll help you out.

Similar Posts:

- Wondering Why You Have Different Credit Scores?

- Negative Records Ruining Your Credit Score?

- TransUnion Survey Shows Consumers Not Checking 2011 Credit

- Laws to Know During Credit Repair and Beyond

- 5 Tips for Repairing Poor Credit

Let's connect!