Active Credit Repair

Credit Repair Services – Consider the Fine Print

When you contemplate signing up with a credit repair agency in an effort to reset your financial priorities and boost your credit score, you need to know what you are getting yourself into for the long haul. Not all agencies claiming to help your score are operating on the up-and-up. Many are just in it for the money and counting on your ignorance of the law and desperation for a better score to make a fast buck.

Here are some tips to help you avoid getting taken in by countless repair scams and what you should know about their service contracts.

- Beware promises that are not realistic such as claims of ‘overnight credit repair’ or ability to remove all negative information from your report. Both concepts are impossible and in some cases illegal.

- Realize you can do everything yourself for free. Consumers have the power to repair their own mistakes. They only part of the equation they have to pay out of pocket for is the credit score information which costs about $15 from each reporting agency. Otherwise, all other work is free including filing disputes of inaccurate negative information contained in a credit report. Read more…

Tips for Negotiating a Pay for Delete Request

One method for eliminating part of your debt load is to request from a creditor or a debt collection agency that a pay for deletion be used to settle your account balance still outstanding. For the consumer, a portion or a full amount of the balance is paid in exchange for a deletion of the account.

There are some collection agents that will lead a consumer to believe a pay for delete negotiation is not legal or they are not able to offer you the option. However, a pay for delete is an acceptable practice for negotiating debts.

Get It in Writing

A key point in a successful negotiation to delete accounts after payment is to ensure all negotiations and made agreements are put in writing. If you are sending a request for a payoff and an account deletion, it should be done by you in writing to the creditor or collection agency and mailed via the certified, return receipt requested option at the post office. It will cost you more in postage but the extra steps will give you the peace of mind that you have left a traceable negotiation on your debt.

Other Tips for Successful Deletion

Once you are able to negotiate a pay for delete scenario with a collection agency or creditor, you will need to Read more…

The Power of Debt Validation and Credit Repair

During the process of credit repair, you may encounter a call (or several) from a debt collector trying to collect on a debt you may not be familiar with or you are not ready to deal with the present time. A powerful and effective tool for dealing with such a scenario is to request a debt validation letter. Making this request is within your right and also protects you from a potentially fraudulent scenario.

What is a Debt Validation?

Debt validation is a legal process which is part of the Fair Debt Collection Practices Act. Debt validation is a request made by a consumer to the creditor asking for proof that the collection agent making content has been assigned to collect the debt. It also helps to establish the total amount you owe as per the original creditor. Read more…

Employment Status Indirectly Affects Credit Score

While 60% of respondents to a Visa Inc survey were technically wrong when they said employment is used to calculate credit scores, they weren’t that off base. Employment status can have an impact on your credit score, even though it’s not directly included in your score.

Consider the things that do affect your credit score: how you pay your bills, the amount of debt you have, the length of time you’ve had credit, the types of accounts you have, and the number of times you’ve applied for credit. Your employment history directly impacts several of those factors.

Your job affects how you pay your bills.

Whether you have a job – and how much that job pays – impacts your ability to pay your bills on time. If you’re unemployed or your job doesn’t have a great salary, that can keep you from paying your bills on time. Payment history is 35% of your credit score and missing payments has a detrimental affect on your credit score. On the other hand, consistent employment and a good salary enable you to pay your bills on time every month and possibly in full.

Having a job lets you keep your debt levels low.

If you’re currently unemployed, that employment status can affect the amount of Read more…

Negative Records Ruining Your Credit Score?

Negative records on your credit report can cause a substantial drop in your credit score. While the tips and strategies we teach at CreditRepair.org may be helpful for many, they will not be as effective in case you have negative records, which keep bringing your score down.

Negative records on your credit report can cause a substantial drop in your credit score. While the tips and strategies we teach at CreditRepair.org may be helpful for many, they will not be as effective in case you have negative records, which keep bringing your score down.

Deleting Negative Records

There are professional credit repair agencies, which specialize in removing negative items from clients’ credit reports. We highly recommend Lexington Law because of their astonishing track record (see the short sample on the left), client testimonials, company ratings and true expertise in this space.

Client Testimonials

If you want to learn about a company’s services, the best people to ask are its current and former clients! Watch the video below to see what people have to say about their experience with Lexington Law and the result of the service on their credit scores and reports.

How Does Rapid Rescoring Work?

Sometimes you may find yourself in a hurry to boost your credit score a few points, for example, to get a better interest rate on a loan. If you know there are credit report errors dragging your score down, but you don’t have time to wait for the dispute process to update your credit report, you may be a candidate for rapid rescoring.

How Rapid Rescoring Works

The credit bureaus offer rapid rescoring as a service to lenders and mortgage brokers. The lender can get the proof of your report error, send it to the bureaus, and have your report updated in about 48 to 72 hours. That’s much sooner than the 30-45 days it would take if you went the regular dispute route.

For rapid rescoring to work, the credit card issuer has to agree to remove the information from your report. Or, you need to have proof of the error. For example, if someone has opened an account in your name, you may have an identity theft affidavit showing that you didn’t open that account. The lender can send your affidavit to the bureaus and have your report updated.

Having high credit card balances can hurt your score and your chances at getting a loan at a good interest rate. If you have the money to pay off the balance, at least enough of it to bring the credit utilization to Read more…

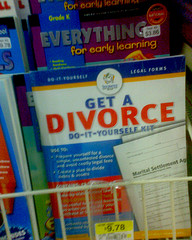

Preventing Bad Credit During a Divorce

A divorce can not only be a painfully emotional time, it can also do a number on your credit rating forcing you to deal with financial hassles of credit repair in addition to the many other aspects of the process. While divorce proceedings do not directly harm your credit, the financial fallout from a contested divorce can damage it.

A divorce can not only be a painfully emotional time, it can also do a number on your credit rating forcing you to deal with financial hassles of credit repair in addition to the many other aspects of the process. While divorce proceedings do not directly harm your credit, the financial fallout from a contested divorce can damage it.

How Divorce Impacts Credit

Couples who marry typically combine and are jointly responsible for the various expenses and financial obligations obtained during the marriage. When a divorce is sought, couples often have issues dividing up those obligations and as a result some of the bills do not get paid. Whether the missed payments are done out of spite or simply due to the lack of funds, the scores of both parts of the former couple will suffer as a result.

Late or missed payments on your mortgage, credit card bills, or other financial obligations can drop your score by a lot of the financial trouble is long-term. Additionally, the black marks on your credit history will remain with you for 7-10 years Read more…

Are Credit Report Disputes Pointless?

Credit report disputes are one of the easiest credit repair strategies. By law, you’re entitled to an accurate report and you have the right to dispute information you believe to be inaccurate, incomplete, or unverifiable. Credit bureaus have to remove this type of information from your credit report after an investigation proves your dispute to be accurate.

Results of Credit Report Study

Are credit report disputes really the best way to spend your credit report efforts? A new report released by the Policy and Economic Research Council (PERC) in May 2011 revealed that less than 1% of credit reports actually have an error that, if corrected, would improve credit scores more than 25 points. The study, called U.S. Consumer Reports: Measuring Accuracy and Dispute Outcomes, also showed that only half a percent of those consumers who disputed report errors saw their scores improve to the next tier. According to this study, it’s very unlikely that a credit report dispute would move your score from Bad to Poor or from Poor to Fair.

Do the Study Results Apply to You?

This information makes it seem that credit report disputes are a waste of time, but they’re still a worthwhile effort, especially if you have significant errors on your report. More than half the people (53%) who participated in the study had VantageScores above 800, that is, scores are in the “A” and “B” categories. It stands to reason this particular segment of the population wouldn’t have serious errors on their report dragging down their scores. On the other hand, only 29% of participants Read more…

What Are Some Common Strategies to Pay Off Derogatory Accounts?

The path to credit repair might require you to pay off some (or all) of your past due accounts. You could easily feel overwhelmed by the amount of your past due accounts, but don’t let this discourage you or cause you to delay your credit repair. You can pay off these accounts one at a time.

Figure Out What You Owe

Make a list of all the negative accounts on your credit report that have outstanding balances. Your credit repair agency may not be able to get these removed these from your credit report unless you can pay off the balance. If you put together a list of the accounts you owe, you can better come up with a plan to pay off all the accounts.

Your accounts may have different levels of delinquencies. Some may be late, but not yet charged-off. Others may be charged-off. And you may have some accounts that are with collection agencies. How you pay your accounts depends on how delinquent they are. For example, if you have accounts that are late, but not charged-off, you might pay them to keep them from becoming charged-off, especially if you don’t have any other charge-offs on your report.

Pay for Delete

You may be able to talk the creditor into removing the negative item from your report in exchange for payment. The pay for delete strategy can be difficult because Read more…

What Should Be In a Credit Repair Contract?

When you work with a credit repair agency, it’s important that you have a contract that spells out what the company will do on your behalf. Read through the contract and ask questions about anything you don’t understand. Here are some things you should expect to be included in a credit repair contract.

Cost

Your credit repair contract should include how much you’re expected to pay for credit repair and when your payment is due. Make sure the amount that’s included in the contract matches any oral agreements made. For example, if you were promised a discount on your services, this discount should be reflected in your contract. What you sign up for is what you’re responsible for paying. Handle any discrepancies before you sign.

Services to Be Completed

In your contract, the credit repair company should include a detailed list of all the services they’ll perform on your behalf. This may include preparing and sending letters to the credit bureau, disputing items on your credit report, etc. Just as with the price, make sure all services you discuss are listed in your contract. Credit repair companies are not supposed to misrepresent their services or make promises to do things they can’t legally do.

Time

By law, your credit repair contract must include the Read more…

Let's connect!