Home > Featured Articles > Rude People Have Better Credit?

Rude People Have Better Credit?

Posted on March 12, 2012

Impatient people have lower credit scores according to a study released in December 2011. But, new data shows a correlation between rudeness and high credit scores. According to a Huffington Post article, some of the rudest cities in the nation are also homes to consumers with the highest credit scores.

Impatient people have lower credit scores according to a study released in December 2011. But, new data shows a correlation between rudeness and high credit scores. According to a Huffington Post article, some of the rudest cities in the nation are also homes to consumers with the highest credit scores.

Based on an annual survey from Travel + Leisure magazine, New York, Miami, D.C., Los Angeles, and Boston are the top 5 rudest cities in the nation. And, Huffington Post says, 4 of those 5 cities also have credit scores higher than the national average: D.C. 686, Los Angeles 684, Boston 687, and New York 682.

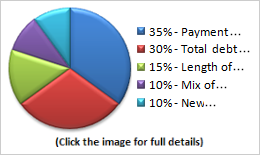

What do people in these cities have that residents of other cities don’t? Huffington Post suggests their aggressive nature keeps them on top of their accounts and paying on time. HP also points out that cities with diversity may encourage consumers to diversity their financial accounts. The mix of your credit accounts is 10% of your credit score, so having different kinds of accounts, credit card and loans, helps your credit score.

In addition, Travel + Leisure says that big cities are known for being direct. Directness can be interpreted as rude, but it might also help you get negative details removed from your credit report or convince a creditor to lower your interest rate or remove a late penalty. For example, “I apologize for being late. Would you consider removing the late penalty since I’ve always been a timely consumer?” is more direct and less rude than “I was only two days late. These late fees are too high anyway.”

The ruder cities have better credit scores and the opposite is generally true. Several cities with the lowest average credit scores are in the Southern states, e.g. Mississippi, Texas, Louisiana, and Georgia. Several smaller cities in the South rank higher for friendliness in Travel + Leisure’s poll. Perhaps residents in these slower-paced cities are not as aggressive when it comes to maintaining their credit, letting payments slip or accepting “no” for an answer.

Two larger Southern cities, Atlanta and Orlando buck the trend. Both ranked in the top 10 rudest cities, have credit scores lowers than the national average.

You don’t have to be rude or grumpy to get a better credit score, but you should be aggressive about improving your credit rating and direct when you’re dealing with businesses in the credit industry.

Don’t give up on credit disputes, settlement negotiations, and pay for delete offers if you’re not successful the first time. Wait a few weeks and try again. You may get a different customer service representative or perhaps the creditor’s position has changed.

Make sure companies follow through on their promises. If you have a signed pay for delete letter, follow up to be sure the item was actually deleted from your credit report after you’ve paid.

Don’t just twiddle your thumbs – take action. New Yorkers are known for being in a rush. Though you shouldn’t rush through your credit repair plan, you don’t want to miss important details, you should treat your plan with urgency.

Image credit

Similar Posts:

- ‘State of Credit’ Shines a Light on Consumer Credit Scores Nationwide

- Pursuing the Perfect Credit Score

- TransUnion Survey Shows Consumers Not Checking 2011 Credit

- Texas Credit Repair Company Accused of Wrong Doing

- Experts Warn Against Sharing Good Credit Scores with the Unworthy

Let's connect!