Credit monitoring

Credit Experts Encourage Regular Review of Credit Report

For consumers who have consistent excellent credit scores, experts warn that ignoring regular reviews of credit reports can spell trouble. Credit reports account for all of the credit activity going on in a consumer’s financial life. It may also be the first indicator that something is wrong and further investigation is necessary in regard to financial criminal activity.

For consumers who have consistent excellent credit scores, experts warn that ignoring regular reviews of credit reports can spell trouble. Credit reports account for all of the credit activity going on in a consumer’s financial life. It may also be the first indicator that something is wrong and further investigation is necessary in regard to financial criminal activity.

Identity and credit card theft is still on the rise and if consumers forgo checking into their own credit reports, they may be missing red flags that someone has hacked their identity. Because technology has afforded may more ways for criminals to secure credit card and other personal information, it is imperative for consumers to Read more…

Statute of Limitations vs. Credit Reporting Time Limit

When you’re dealing with debts and negative credit report entries, there are two time limits you should know – the statute of limitations on debt and the credit reporting time limit. Many people get these two time limits confused, but it’s important that you get them straight. One impacts you in a lawsuit and the other deals with negative information on your credit report.

Debt Statute of Limitations

Each state has a law that defines how long a creditor or collector can win a civil lawsuit for a debt that you allegedly owe. The time limit varies from state to state depending on the type of debt. For example, a credit card balance may have a different statute of limitations from an installment loan.

There are a few important things to know about the statute of limitations. First, the statute of limitations is like a stopwatch. The clock starts ticking on the last date of activity on an account. It can start over if you take certain action on an account, like making a payment or payment arrangement. In some states, even stating that the debt is yours can restart the statute of limitations.

The statute of limitations does not stop a creditor or collector from Read more…

How Can You Get a Free Credit Score

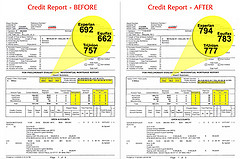

Every consumer in the US that has established a credit history has a credit report listed with three of the credit reporting agencies: Experian, Equifax, and TransUnion. The credit report lists all of the activity and accounts a consumer has with creditors including mortgages, personal loans, credit card accounts, and other lines of credit and obtaining it is the first step of credit repair. Activity is reported by the creditors for each consumer whether it is positive (ie: pays on time) or negative (ie: missed payments). That information is then used by other banks and lenders to determine the creditworthiness of a consumer. A lot of good reported information will reflect responsibility with credit. Too much bad information on a credit report shows lenders a consumer may be a risky proposition. Bad credit histories will lead to higher interest rates and even rejections on credit applications.

There are a lot of advertisements that mislead consumers into thinking they can easily get a copy of the credit reports for free by signing up with select companies. The problem is that many of these ads aren’t entirely true. While you can get a free copy of your report, you also have to sign up for costly credit monitoring or other service that requires monthly payments for membership.

Obtaining Your Report Without Obligation

All consumers are entitled to a free credit report each year from the three credit bureaus. You do not need to register for membership with any company to receive the free report. If you want to request copies of your credit history, use the following contact information: Read more…

The Truth About Free Credit Reports and Credit Scores

Remember those FreeCreditReport.com commercials? You used to see them all the time when you watched television late at night. Now, you don’t really see them anymore. That’s because the federal government made it a rule that any website offering a free credit report had to include a prominent disclosure. The disclosure had to reveal that the true place to obtain your legally-free credit report was through AnnualCreditReport.com. Radio and television advertisements for free credit reports will soon have to do the same thing.

Those credit reports that used to be free, now cost at least $1. It’s how free credit report companies get around the government-required disclosure. However, it still stands true that the only place to get a truly free credit report is through AnnualCreditReport.com. Read more…

Let's connect!