Home > Featured Articles > ‘State of Credit’ Shines a Light on Consumer C...

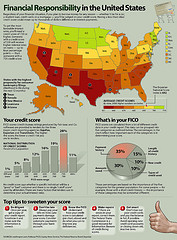

‘State of Credit’ Shines a Light on Consumer Credit Scores Nationwide

Posted on October 12, 2011

Congratulations citizens of Wausau, Wisconsin! You’ve been recognized as having the nation’s highest average credit score. Conversely, citizens of Harlingen, Texas are encouraged to step it up after finding they have the lowest average at 686, the only city to dip below an average of 700.

The second annual State of Credit list was provided by Experian, one of three major credit bureaus which analyzed 143 cities across the nation.

Four of the top five cities with the highest average credit score are located in the Midwest, which include Minneapolis, Minnesota; Madison, Wisconsin and Cedar Rapids, Iowa and the lone California city of San Francisco rounds out in 5th.

High credit scores are associated with higher employment rates and lower amounts of debt, whereas lower credit score reinforce the exact opposite. Harlingen, for example, has an unemployment rate of 13 percent.

Though economic outlooks are rather bleak right now, the national average credit score has risen one point since last year, perhaps indicating Americans moving toward financial responsibility.

In any case, working to raise your credit score, whether it is in need of credit repair, or already a shining star is a very strong indicator of financial success in the future.

Source USA Today

Image source

Similar Posts:

- Rude People Have Better Credit?

- “Balance Transfer Day” Participants Encouraged to be Mindful of Potential Credit Score Risks

- Financial Experts Advise Caution with Zero-Percent Balance Transfer Credit Cards

- Experts Warn Against Sharing Good Credit Scores with the Unworthy

- Consumer Credit Use May Indicate Better Economy

Let's connect!